Current Inflation Scenario in India: Sources and Implications

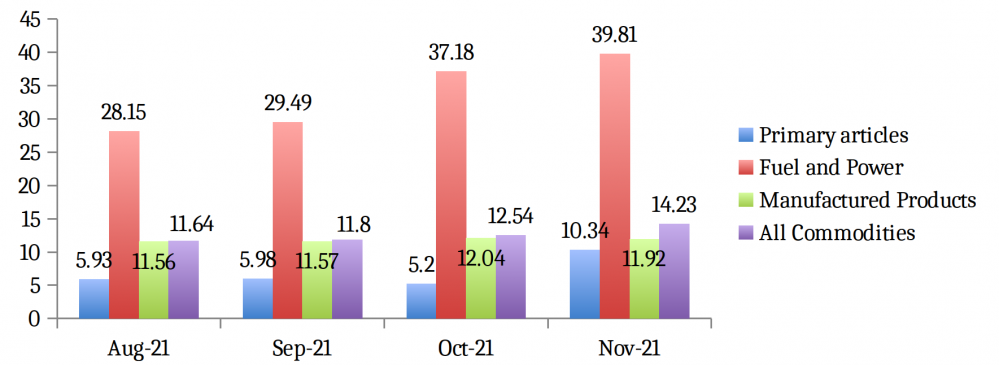

The December 14th, 2021 press release by the Department for Promotion of Industry and Internal Trade of the Ministry of Commerce and Industry shows that the year-on-year rate of whole price inflation (provisional) for the month of November stood at 14.23 percent. Figure 1 shows that while all the major commodity groups have contributed to price rise, the substantial contributions have come from fuel and power, and manufactured products. The inflation rate for fuel and power (with a weightage of 13.15 percent in WPI) has increased from 28.15 percent in August to 29.49 percent in September and then further to 37.18 percent and 39.81 percent in October and November of this year respectively. On the other hand, the inflation rate for the manufactured products group, which has a weightage of 64.23 percent, has remained steady around 12 percent in the last four months. As for the primary articles group (weightage of 22.62), after hovering between 5-6 percent during August to October, inflation rate increased to 10.34 percent in November.

Figure 1: Annual rate of inflation across major commodity groups during August-November, 2021

Source: https://eaindustry.nic.in/pdf_files/cmonthly.pdf

Within the primary articles group, notwithstanding fluctuations, food articles, such as pulses, eggs, meat and fish, and milk show positive trend in inflation rate over the past six months. Further, inflation in wheat and fruits shows an upward trend during September-November, 2021. In case of pulses, the numbers for the last six months indicate easing up of inflation. On the other hand, price pressures from food items, namely, paddy, potato and onion have been deflationary. A look at the trends in inflation rates of the food items over the past six months suggests that the inflation in the primary food articles is mostly transitory that can be attributed to seasonal variations and supply side disruptions. However, as indicated in the Monetary Policy Report (MPR), October 2021 of the RBI, rising inputs and operational costs are also responsible for higher inflation in case of certain items such as milk, eggs, meat and fish.

The other sub-groups of commodities within the primary articles, namely, non-food articles, especially oil seeds and minerals, crude petroleum and natural gas show sustained and very high level of inflation over the last six months. A part of the inflation in some of these commodities has spilled over from the international market. For example, the international prices of vegetable oil and oil seeds firmed up substantially in recent months. India imports about 58 percent of domestic consumption of edible oil[1]. Thus, an increase in the international price has resulted in an increase in the domestic price as well. The same story goes for crude petroleum as well. For the oil seeds, though the inflation rate is still high, it has however, shown a tendency to ease up a bit in recent months.

Inflation in LPG, petrol and high-speed diesel (HSD) within the commodity group fuel and petrol has shown no sign of waning in the last six months. Increase in the prices of these items affects everyone either directly or indirectly, and hence is a cause of concern.

Manufactured products, such as, some food products like vegetable and animal oils and fats, textiles, paper and paper products, chemical and chemical products, rubber and plastic products, basic metals and fabricated metal products experienced high and sustained inflation in the last six months. MPR, October 2021 of the RBI, suggests raising costs in inputs, transportation and fuels are responsible for the high rate of inflation in manufactured products. Disruption in the global supply chain has also contributed to raising input costs. In fact the same report suggests that input costs of the manufacturing firms will continue to increase throughout the third quarter of the fiscal year 2021-22.

A reading of India’s current inflation scenario gives an impression that it is largely being driven by increased costs of raw materials and supply chain disruptions at both global and domestic levels. Hence, the interventions will have to be in terms of removing supply side bottlenecks wherever possible.

As discussed above, though inflation in primary food articles, at least to some extent, could be transitory, inputs costs in certain cases have gone up resulting in higher selling prices. Against the backdrop of stagnated rural wages, higher food prices could reduce real income of the rural population and thereby overall demand in the economy. Consequently, besides intervention by the government in terms of providing access to quality inputs by farmers, measures, such as reducing import duties need to be taken to control prices of essential items. Central Government, in fact, took such measures in recent past in case of certain commodities such as pulses.

Given that hike in fuel prices affects everybody, reduction in excise duty and VAT shall surely give some relief to common people. Besides, it will reduce operational costs of the firms. However, given the fragile fiscal health of many states, we may not see another round of reduction in taxes soon. Besides, giving up on this source of revenue will force the states to resort to market borrowing that in turn may cause inflation in future.

Since current bout of inflation is cost-pushed in nature, RBI should continue to adopt accommodative monetary policy, at least for now. In fact, a strict monetary policy may cause more inflationary pressure by raising the cost of borrowing. In other words, the RBI should continue to back economic growth and employment generation while keeping a strict vigil on the inflation numbers. On the part of government, it is worth reiterating that efforts should be made to remove supply side bottlenecks both in the farm and non-farm sectors. Otherwise continuous increase in inflation when the post-pandemic economic recovery is still underway, will dampen demand and thereby investment and employment generation in the non-farm sector. With the threat of another round of disruptions in economic activities due to the spread of omicron variant looming large, supply-side constraints may create further inflationary pressure even in the farm sector.

[1] See Monetary Policy Report, October 2021, page no. 15.

* Guest blog by Binoy Goswami, South Asian University