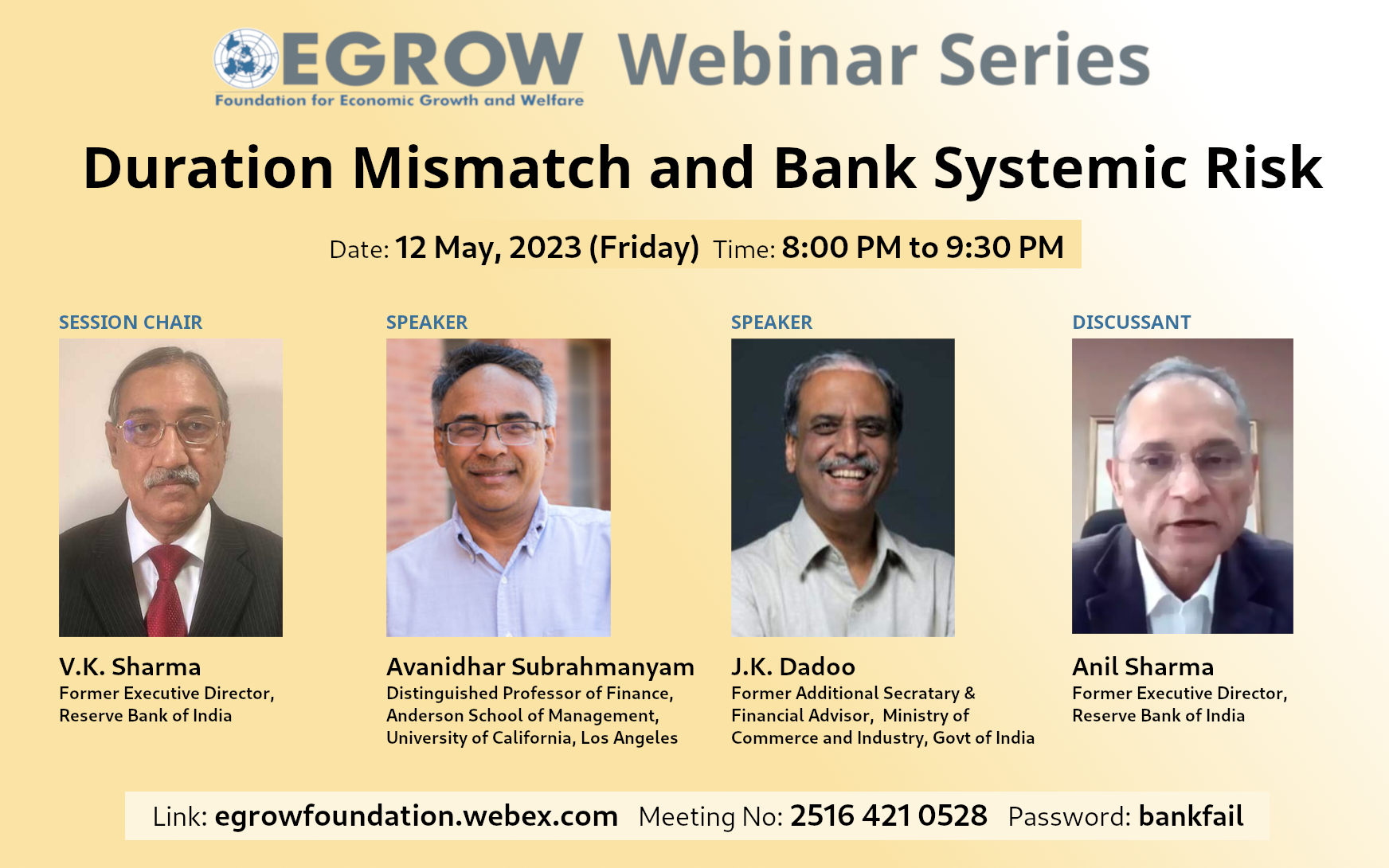

Duration Mismatch and Bank Systemic Risk

Webinar Link

Meeting No: 2516 421 0528

Password: bankfail

Certificate of Participants

To recieve certificates, please register and attend

Abstract

Duration mismatch refers to a situation where a financial institution borrows short-term funds to lend long-term loans, creating a gap between its assets and liabilities. This mismatch exposes the institution to interest rate risk and liquidity risk, leading to financial distress and potentially systemic risk in the banking system. Empirical evidence suggests that duration mismatch can amplify systemic risk by increasing the probability of bank failures and contagion effects. To mitigate this risk, regulators have implemented policies like liquidity requirements and stress testing. However, some argue that stricter regulations are needed to reduce the likelihood of future financial crises. Therefore, it is crucial for financial institutions and regulators to remain vigilant and take measures to reduce the risk of systemic crises. The discussion will deliberate on the role of regulations in reducing risks arising out of duration mismatch.

About the Speakers

V.K. Sharma

V.K. Sharma is a former Executive Director of Reserve Bank of India (RBI) and a former Member of the Markets Committee of the Bank for International Settlements, Basel, Switzerland. He is currently on the Board of Governors of International Management Institute, New Delhi, and Academic Advisory Board of MIT World Peace University's School of Economics, Pune. He is also an Independent Director on the Board of Equitas Small Finance Bank Ltd.

Mr. Sharma has had an illustrious career in the field of central banking. As Executive Director of RBI, he was responsible for 11 critical and sensitive departments, covering areas such as financial markets, foreign exchange reserves management, internal debt management, human resources, administration, currency management, rural planning and credit, financial inclusion, customer service, premises, and regulation and supervision of urban co-operative banks.

During his tenure at RBI, Mr. Sharma served as Chairman/Member/Director of several important Committees/Working Groups/Governing Boards/Councils/Bank Boards and represented RBI in various prestigious national and international fora. After retirement, he was appointed by the Government of India as Chairman of the Working Group on Common Clearing for Commodity Exchanges.

Mr. Sharma has a versatile performance track record with a strong action, outcome, result, and delivery orientation in policymaking and execution. He has formidable credentials in Financial and Derivatives Analytics and Risk Diagnostics & Risk Management Solutions.

Mr. Sharma has several research papers, articles, and speeches to his credit, including one on the Eurozone crisis delivered at the European Parliament in Brussels. His work has been published in leading business newspapers, prestigious journals like London's Central Banking and Bank for International Settlements (BIS) Reviews, and one titled Derivatiff, which was covered by The Economist of London in its issue dated 16 February 2013. Besides, his paper "The Challenge of Financial Leverage in Modern Banking" was published in the April-June 2015 issue of Vikalpa of IIM Ahmedabad.

Mr. Sharma has also been a guest speaker at management institutes, including IIMs. He has successfully qualified the Online Proficiency Self Assessment Test for Independent Director’s Databank of Indian Institute of Corporate Affairs, Ministry of Corporate Affairs, Government of India.

Overall, Mr. V.K. Sharma is a highly accomplished central banker with a vast experience in policymaking, risk management, and research. He has made significant contributions to the field of finance and banking and continues to be a sought-after advisor and speaker in his area of expertise.

He holds a M.Sc. in Physics and B.Sc. in Physics, Pure and Applied Mathematics. He also holds an Advanced Studies Certificate in International Economic Policy Research from Kiel Institute of World Economics, Kiel, Germany. From RBI, he was the first recipient of the prestigious Lord Aldington Banking Scholarship Award.

Avanidhar Subrahmanyam

Professor Subrahmanyam is a highly distinguished scholar in finance, currently holding the Goldyne and Irwin Hearsh Chair in Money and Banking at UCLA. He received his Ph.D. in finance from the Anderson School in 1990 and has since become a renowned expert in the field, with research interests that include the relationship between a firm's trading environment and its cost of capital, behavioral theories for asset price behavior, and empirical determinants of equity returns. He has authored or co-authored over a hundred refereed journal articles on these and other subjects, published in top finance and economics journals. Professor Subrahmanyam is also a member of the Working Research Group on Market Microstructure at the National Bureau of Economic Research (NBER) in Cambridge, Mass.

He is a highly acclaimed finance scholar and professor, known for his prolific research and numerous accolades. He is among the most cited scholars in his field, with over 37,000 published papers citing his work. He has received multiple awards for his research, including best paper awards at prestigious finance conferences. He has presented seminars at top institutions around the world, and is a co-organizer of the National Bureau of Economic Research's market microstructure conference series. He has served on editorial boards of top finance journals, and has consulted for a variety of corporations and financial institutions. Additionally, he has given keynote speeches on behavioral finance and financial liquidity at numerous locations worldwide.

J.K. Dadoo

Mr. J.K. Dadoo is a former civil servant who has held important positions in the Indian government & 5 Union territories. over the past few decades. He has held several positions viz Additional Secretary and Financial Adviser in the Ministry of Commerce and Textiles. Prior to this role, Mr. Dadoo served as Joint Secretary in the Department of Commerce within the Ministry of Commerce, where he was responsible for overseeing trade promotion initiatives in Australia, New Zealand, Fiji, and Papua New Guinea. He also oversaw the National Centre for Trade Information, the Indian Institute of Foreign Trade, and various export promotion councils, including the Council for Leather Exports, the Telecom Equipment and Services EPC, and the Sports Goods Export Promotion Council. Additionally, he served as Director General of Trade Remedies, where he dealt with anti-dumping and subsidies, and worked with the Board of Safeguards. He was on the board of seven PSU's of two leading educational instututes of Government of India as Financial Advisor.

He also served as Administrator for the Lakshadweep Islands, equivalent to the Head of State, from 2009 to 2011. Before that, he was the Principal Secretary for Environment, Forests, and Wildlife in the Government of NCT of Delhi from 2006 to 2009 and Chairman of the Delhi Pollution Control Committee.

Mr. Dadoo has also held important positions throughout his career, including serving as the Development Commissioner for Goa, Acting Chief Secretary for Goa, and Development Commissioner for Daman, Diu, and Dadra & Nagar Haveli. He also served as Counselor Coordination in the Embassy of India in Moscow from 2000 to 2004 and held several positions in the Ministry of Defence from 1997 to 2000, including Director (Air Force), Director (Resettlement), and Director (International Cooperation).

Earlier in his career, Mr. Dadoo held various positions in the Delhi government, including Additional Commissioner of Sales Tax, Additional Director and Joint Secretary (Education), Joint Secretary (Health), and Sub-Divisional Magistrate. He also served as Deputy Commissioner in the Lower Subansiri District and Chairman of the District Rural Development Agency in 1988-89 and as Joint Secretary of Planning and Development in the Government of Arunachal Pradesh from 1987 to 1988.

Mr J.K. Dadoo holds a Master's degree (MBA) in Marketing from the Indian Institute of Management (IIM), Ahmedabad. He also has a Bachelor of Law (LLB) degree from Delhi University and topped Delhi University in Bachelor in Economics from St. Stephen's College.

Anil Sharma

Anil Kumar Sharma was the Executive Director, Reserve Bank of India. Before taking over as ED, he was headed the Enforcement Department of Reserve Bank of India as Chief General Manager. He has done his Masters in Economics from Doaba College Jalandhar, Punjab and was UGC Fellow at Gokhale Institute of Politics and Economics, Pune before joining RBI in 1986. He holds a Diploma in Treasury and Risk Management and is a Certified Associate of Indian Institute of Bankers. His experience in the Bank lies in the area of management of currency and banking, rural credit, and supervision. He also worked as member of faculty in RBI College of Agricultural Banking, Pune.