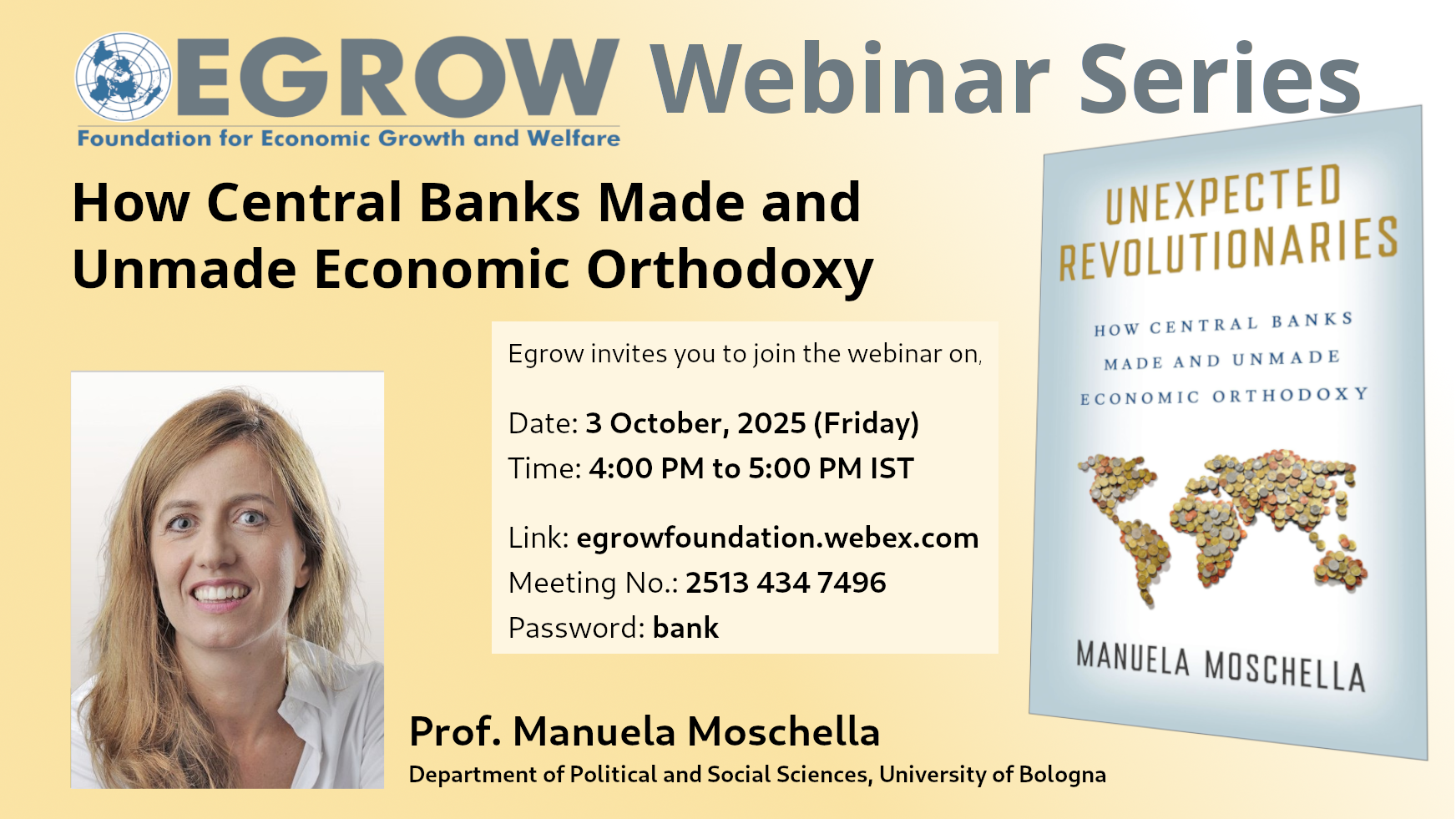

How Central Banks Made and Unmade Economic Orthodoxy

Webinar Link

Meeting No: 2513 434 7496

Password: bank

Certificate of Participants

To recieve certificates, please register and attend

Abstract

Central banks are often seen as conservative and politically neutral institutions, committed to upholding conventional macroeconomic wisdom. However, the global financial crisis of 2008 and the COVID-19 crisis of 2020 revealed a striking shift: central banks embraced unconventional policies that challenged long-held expectations. Beyond traditional approaches, they began implementing practices such as broad liquidity support, quantitative easing, and even engaging with issues like inequality and climate change.

At the core of this transformation lies the political dimension of central banking. While formally independent, central banks rely on political support to legitimize their policies and authority. To secure this support, they strategically manage their reputations among elected officials, financial markets, and the public. Facing reputational risks amid recessionary and deflationary pressures, institutions like the Federal Reserve and the European Central Bank departed from orthodoxy, working in tandem with fiscal authorities to address crises and restore trust.

This webinar will explore how and why central banks have transformed their roles, what this means for democratic accountability, and the implications for the future of the global economic order. Participants will gain critical insights into the evolving relationship between monetary policy, politics, and society in the 21st century.

About the Speakers

Manuela Moschella

Manuela Moschella is a Professor of Political Science in the Department of Political and Social Sciences at the University of Bologna, where she also serves as Director of the research centre CONNECT – Transnational Connections and Governance. She is an Adjunct Professor at Johns Hopkins University SAIS-Europe and one of the editors of the Review of International Political Economy. She has served as Associate Fellow at the Europe Programme at Chatham House and as Senior Fellow ar the Centre for International Governance Innovation (CIGI). Her research focuses around the political dynamics of economic policymaking, the evolving interplay between technocratic governance and democratic accountability, and the transformation of European political economy and European economic governance. Moschella’s latest book is titled Unexpected Revolutionaries. How Central banks Made and Unmade Economic Orthodoxy (2024, Cornell University Press). She is also one of the co-editors of European Political Economy: Theoretical Approaches and Policy Issues