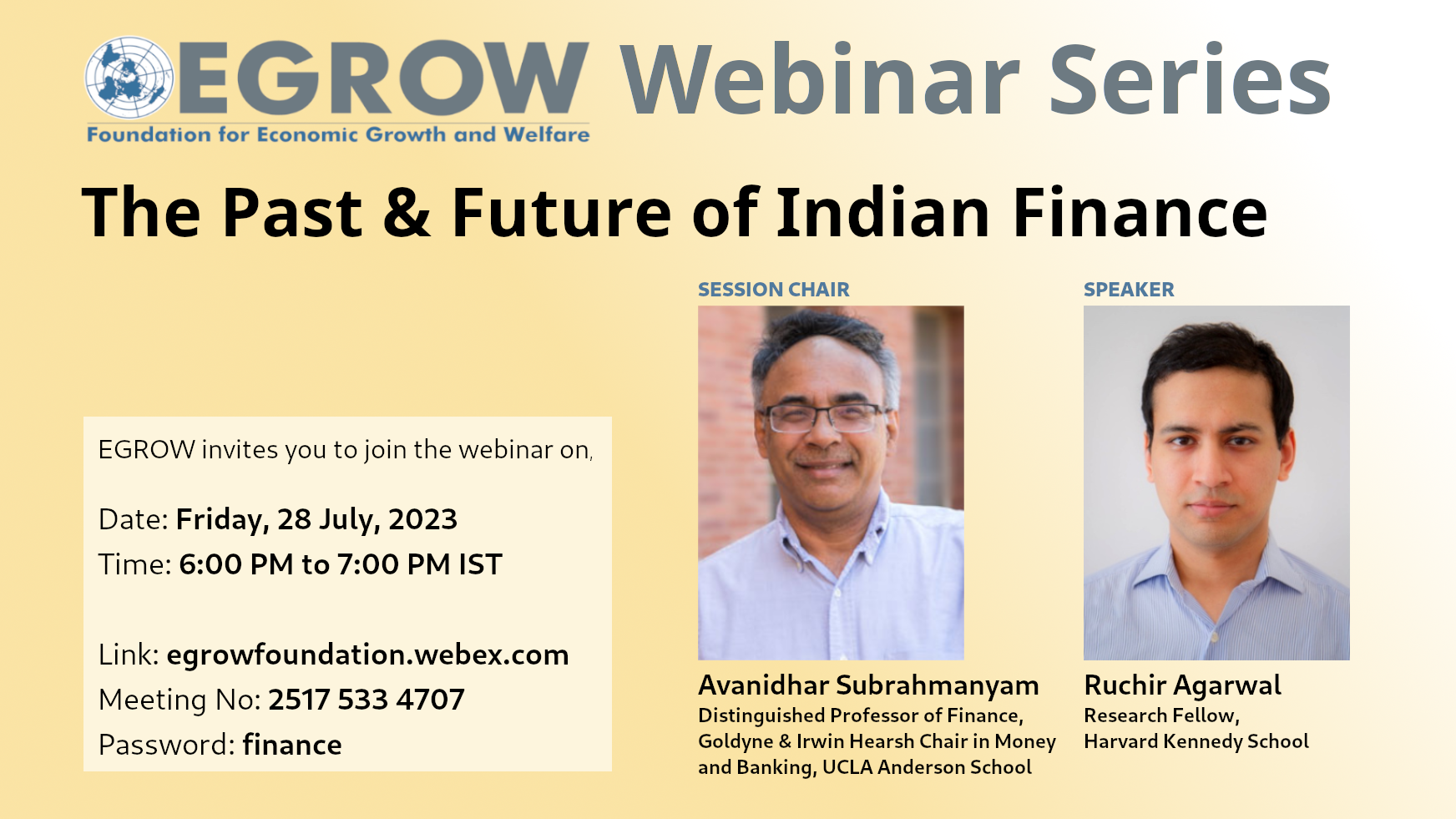

The Past & Future of Indian Finance

Webinar Link

Meeting No: 2517 533 4707

Password: finance

Certificate of Participants

To recieve certificates, please register and attend

Abstract

India’s growth story depends on the vitality of its financial system. Within the span of five years, the Indian economy has endured two unprecedented shocks: the 2019 economic slowdown triggered by a financial crisis, and the COVID-19 pandemic. However, after these episodes, one vital question emerges: how resilient will India’s financial system be in the face of future challenges? This discussion embarks on three missions. First, it dissects the origins and aftermath of the Indian Financial Crisis of 2018-20, sparked by a run on the shadow banks. Second, it examines how India fortified its financial system in the wake of this financial crisis and the pandemic, consequently shielding itself from the global banking disruptions of 2023. Finally, it gazes ahead at potential challenges and opportunities, sketching a blueprint for key reforms. Overall, the future trajectory of India’s economic growth, whether a modest 5.5% or a bold 7.5%, rests significantly on the progress of ongoing financial sector reforms.

About the Speakers

Avanidhar Subrahmanyam

Professor of Finance Avanidhar (Subra) Subrahmanyam (Ph.D. ’90) is an expert in stock market activity and behavioral finance. He is known for his pathbreaking research in the use of psychological principles to explain stock price movements and has published numerous articles in leading peer-reviewed finance and economics journals.

Appearing frequently in the media, Subrahmanyam is consulted for his expertise on the superior performance of value stocks and the phenomenon of stock market momentum to analyze spikes in gasoline prices, herd-like behavior around Apple stock, uncertainty in everyday use of the bitcoin crypto-currency and the effects of war on the stock market.

Subrahmanyam’s current research interests range from the relationship between the trading environment of a firm’s stock and the firm’s cost of capital to behavioral theories for asset price behavior and empirical determinants of the cross-section of equity returns. “We need to accept that humans are governed by a number of non-rational considerations,” he says in relation to investing behaviors. “An investor may be reluctant to admit an erroneous investment decision, which may prevent correction of over-heated stock market valuations. Academic research has indicated to investors that irrational investing can cause a significant loss of wealth.”

A founding editor of the Journal of Financial Markets, Subrahmanyam previously served as associate editor of the Review of Financial Studies and the Journal of Finance. He is a member of the National Bureau of Economic Research’s Working Research Group on Market Microstructure.

His scholarly efforts have been recognized with best paper awards at the Western Finance Association meetings and the International Conference of Finance in Taiwan, and he was honored with the Smith Breeden Prize for the best paper published in the Journal of Finance (1999). His documentation of market liquidity led to a number of studies analyzing why trading costs fluctuate over time and earned him the Fama-DFA prize for the best paper on investments published in the Journal of Financial Economics (2000).

Subrahmanyam has served as a consultant to the Nasdaq Stock Market, the National Stock Exchange in Mumbai, India, San Jose Mercury News and Irwin/McGraw-Hill. He is a UCLA Anderson Inspirational 100 alumnus.

Ruchir Agarwal

Ruchir Agarwal is an economist with experience across advanced, emerging, and frontier economies. He is an M-RCBG Research Fellow at the Harvard Kennedy School and Co-Founder of the Global Talent Network. Before these roles, he spent over a decade at the International Monetary Fund (IMF), served as a Senior Advisor to the G20 Finance Health Task Force, and was an Executive Fellow at the Yale School of Management.

During the pandemic, Ruchir created and implemented the $50 billion IMF Pandemic Plan as the Head of the IMF Global Health & Pandemic Response Task Force. He also established the Multilateral Leaders Task Force, which brought together the heads of the IMF, WHO, World Bank, and WTO to fight the pandemic.

He has been exploring strategies to finance global public goods such as pandemic prevention, frontier science and talent, and climate security. He co-founded the Global Talent Network and the Global Talent Lab, which aim to discover and nurture individuals who have the potential to drive breakthroughs in science and innovation.

Ruchir's previous roles include lead economist for India during the COVID-19 pandemic, lead economist for Mongolia during the 2017-18 crisis, and lead economist for Sweden, Lebanon, and Bhutan. He also worked on the rescue package for Cyprus and the restructuring of Greek bank subsidiaries during the European debt crisis. His work covers financial, fiscal, and growth policy issues across Asia, Europe, the Middle East, and the Americas.

Cited by major publications and governments, Ruchir's research focuses on the future of money, global public goods, and the impact of talent on long-term growth.

Ruchir earned his Ph.D. in Economics from Harvard University under the supervision of Greg Mankiw and Jeremy Stein. He received the Allyn A. Young prize for teaching excellence, and continues to share his experience with students through economics and finance lectures at various universities. He is also a Non-Resident Fellow at the Center for Global Development and Innovation Fellow at Schmidt Futures.