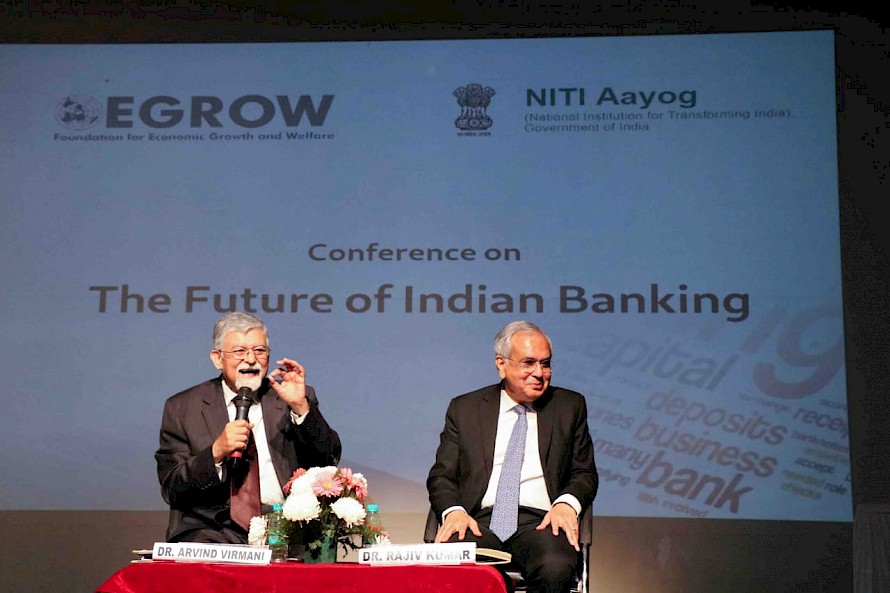

"The Future of Indian Banking" - Conference of EGROW co-hosted with NITI Aayog

Special Session

Shri Rajiv Kumar, Secretary, Department of Financial Services, Ministry of Finance

The key messages from the deliberations included:

- Technology has already become critically important for banking and will continue to become more important in future. This will serve to bring banking closer to the customer, including those in rural areas, and also bring tremendous efficiencies with greater speed of service at much lower cost.

- Appropriate skilling of human resources in banking is necessary to keep pace with best credit practices and new technology-based banking paradigm. In addition, banking staff needs to be trained to prepare for a larger role of banking in expanding the Indian economy.

- The banking industry has to be continuously prepared for fraud and rising cyber security risks.

- The banking industry requires a suitable vigilance mechanism for trustworthy banking but with a clear mandate to distinguish between deliberate action, criminal negligence, error in judgment or unforeseeable business risk.

- There may be a need to think once again in terms of specialised and sector based banking.

- Public sector banks have consistently supported social banking, unlike private and foreign banks. Public sector banks should continue to do so.

- To compete effectively, globally, there is a need for bigger banks in India to avail economies of scale

- There is a need for more research on banking sector issues, specific to the Indian context.

In next few days, on EGROW website, papers discussed in the Conference will be uploaded for ease of reference.

Policy Panel

Chair: Dr. Charan Singh, CEO, EGROW Foundation

Panelist for the Policy panel:-

- Dr. K.V. Subramanian, Cheif Economic Advisor, GoI

- Dr. Andreas Bauer, Senior Resident Representative for India, Nepal and Bhutan, IMF

- Dr. Marius Vismantas,Lead Financial Sector Specialist, World Bank

- Shri Ajit Pai, OSD, NITI Aayog

Bankers Panel

Chair: Shri Yaduvendra Mathur, Additional Secretary, NITI Aayog

Panelists for Bankers Panel:-

- Shri Sunil Mehta, Managing Director, Punjab National Bank

- Shri R. K. Takkar, Former Managing Director, UCO Bank

- Shri Prashant Saran, Former Member, SEBI

- Shri Dalbir Singh, former, CMD, Central Bank of India and former MD, Oriental Bank of Commerce

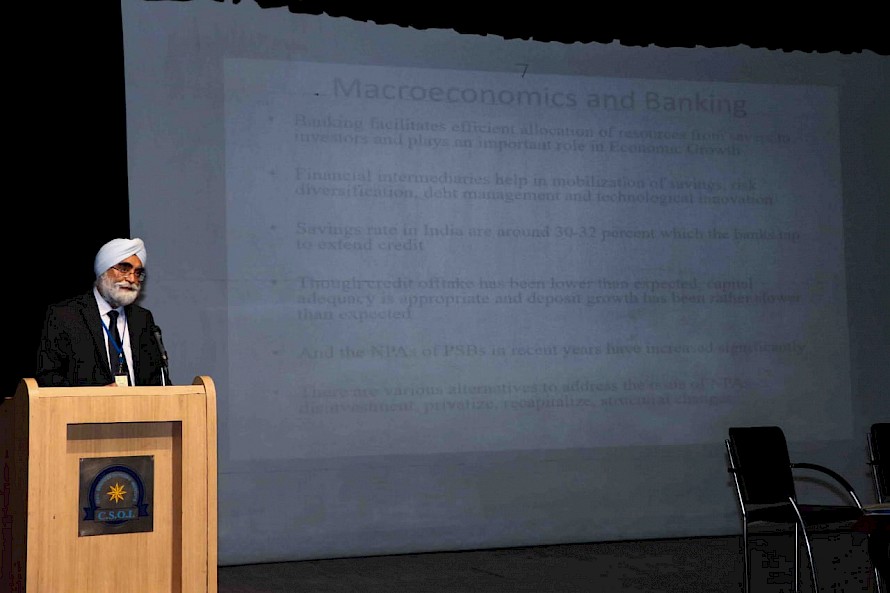

Academic Session 1

Chair: Prof. Upinder Sawhney, Punjab University

Panelists in Academic Session 1:-

1. Prof Naliniprava Tripathy, IIM Shillong

Topic: Are Financial Development and Economic Growth Releated? Evidence from ARDL model

2. Shri Abdus Salam, Symboisis University

Shri K. V. Anirudh, Symboisis University

Topic: A Study to analyse impact of Insolvency and Bankruptcy Code

3. Shri Bilal Khan, Jamia Milia Islamia

Prof. Halima Rizvi, Jamia Milia Islamia

Topic: Prompt Corrective Action

Academic Session 2

Panelists in Academic Session 2:-

Chair: Shri Ajit Pai, OSD, NITI AAyog

1. Prof. Deepak Tandon, IMI, Delhi

Topic: Revisiting Alternative to Banking Amidst Capital Standards of Basal 3

2. Prof. Rachita Gulati, IIT Roorkee

Topic: Bank Regulation and Competition Policy Evidence from India and its peers in BRICS

3. Ms. Anamika Singh, IIT Roorkee

Topic: Impact of Size structure on liquidity determinants and their association with Indian Banking liquidity.

Valedictory Session

Shri Nandkumar Saravade, CEO, ReBIT Technology and Banks in India delivered the valedictory address and spoke on Technology and Banks in India. He said that technology and banking are increasingly becoming inseparable and that there has been a technological evolution in the banking sector. The increasing use of technology can benefit from deeper internet penetration. Banking and lending will be increasingly reliant on big data, machine learning, and credit appraisal algorithms. India has to face many challenges in adopting digital banking. Illustratively, banking infrastructure is still inadequate, and number of ATM’s per million people is also very low. In the technological advanced world of banking, there are increasing chances of security breaches and digital frauds. Therefore, operational risk management would require better IT controls.

Pictures of Events