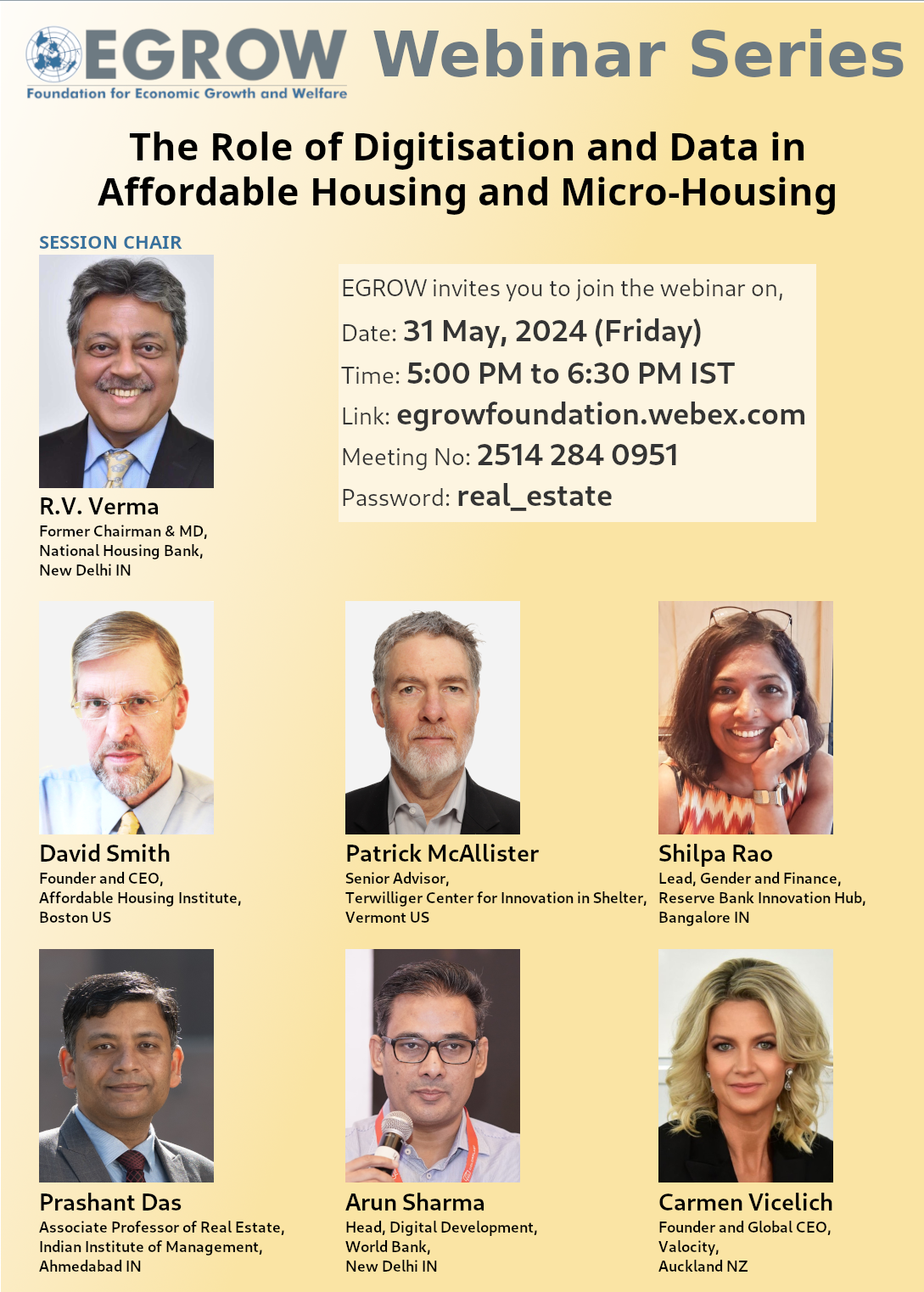

The Role of Digitisation and Data in Affordable Housing and Micro-Housing

Webinar Link

Meeting No: 2514 284 0951

Password: real_estate

Certificate of Participants

To recieve certificates, please register and attend

Abstract

Digitisation and data analytics are enhancing affordable housing and micro-housing by improving efficiency, lowering costs, and increasing accessibility. Also, digital innovation can address housing challenges, foster inclusivity, and promote sustainable development. The panelists will explore how digital transformation is reshaping the housing sector.

About the Speakers

R.V. Verma

In his long career spanning nearly 40 years in the financial sector, housing and mortgage industry, including regulation and supervision activities, Mr Verma has held several leadership positions. Beginning his career with the Reserve Bank of India, Mr Verma has served as CMD of National Housing Bank (NHB), 1st MD&CEO and Central Registrar, CERSAI, Chairman and Whole Time Member at the Pension Fund Regulatory and Development Authority (PFRDA), twice-elected (by member countries) Chairman of the Asia-Pacific Union for Housing Finance (APUHF), 1st Chairman of the Board of India Mortgage Guarantee Corporation (MGC). He also served as Member on a number of Committees appointed by the Government of India and Reserve Bank of India, and played an important role in the formulation and launch of various national schemes and ground breaking programmes on affordable low-income housing and informal sector housing.

Mr Verma also served on a number of Boards, including Part-time Chairman of AU Small Finance Bank, India Country Chairman of Valocity, Director on the Boards of SBI Pension Fund and Encore ARC. He also served as Member of the Advisory Committee of Insolvency and Bankruptcy Board of India (IBBI) and Consultant to the World Bank Group.

Masters in Economics from Delhi School of Economics and MBA from FMS, Delhi University, Mr Verma played a pivotal role in the introduction and development of the Residential Mortgage Securitisation market and Mortgage guarantee scheme in India.

David Smith

Over a career spanning 47+ years, David Smith’s work in affordable housing has been committed to improving housing for people who need it and deserve it, unrelenting commitment to quality social and economic outcomes, and continuing willingness to take pioneering risk. Having twice founded companies that have become leaders, first in the US and now globally, he is recognised as a visionary who makes things happen.

Affordable Housing Institute (AHI), a US §501c3 non-profit public charity, has worked in over 50 countries providing policy, program, and housing public-private partnership (PPP) structuring and implementation services. Impact entities seek out AHI for new affordable housing financial or delivery solutions – supply-side, demand-side, or hybrids addressing both value chains synergistically. Multiple-repeat customers include the World Bank, the International Corporation, and the Interamerican Development Bank. AHI also played a seminal role in the conceptualisation, initial funding, and launch of Sitara (https://www.sgrlimited.in/new-home.php), a cutting-edge women-led Indian fintech that in seven years has grown 15x, and in which AHI used a grant from the Bill & Melinda Gates Foundation to become a founding investor.

In March 2022, David conceptualised and launched the Rehousing Ukraine Initiative, a multi-entity team with Ukrainian and European partners, that envisions a late-war and postwar environment where Ukraine prevails at the cost of immense urban damage. RUI is currently providing pro-bono advisory and program design support to relevant Ukrainian ministries and continues to expand its network and our work.

David also is a sought-after speaker at conferences around the world, has published hundreds of articles over the decades, and teaches (both virtually and in-person) three Harvard Graduate School of Design Executive Education courses: Affordable Housing, Real Estate Development fundamentals, and Real Estate Finance Fundamentals.

Patrick McAllister

Patrick has over 20 years’ experience in the public, private and non-profit sectors advancing residential mortgage, financial inclusion, and the enabling environment for affordable housing finance. In his current role he oversees the development and implementation of TCIS’s strategy to improve the enabling environment on which housing investment depends. Previously, he served as the Asia Director for Housing Finance and Market Development where he led innovative housing finance approaches including creation of new corporate structures, investment vehicles, microfinance, savings, and advisory services in South and Southeast Asia.

Before joining Habitat for Humanity, he was the founder of Cauris Consult advising clients including the Bill and Melinda Gates Foundation, Citi, and the World Bank Group on financial inclusion, consumer protection and market development. He has also worked in private banking and at the US Department of Housing and Urban Development, creating alternatives to foreclosure for low-income borrowers and securitisation of mortgage assets. Geographically, his experience spans Europe, Africa, Asia, and the Americas.

He speaks English and French and holds Irish and US citizenship. Mr. McAllister earned certificates in International Housing Finance, Bonds and Securitisation from the Wharton International Housing Finance Program and Certified Expert in Financial Inclusion Policy from the Frankfurt School; a master’s degree in development studies from University College Dublin; and a bachelor’s degree in economics from the University of Wisconsin.

Shilpa Rao

Shilpa Rao, is a seasoned Development Sector Professional with ~17 years of experience. Shilpa has made significant contributions to financial inclusion efforts focused on Micro-housing and Housing Finance in Multilateral Agencies like the IFC and the World Bank Group, as well as within social enterprises in the financial inclusion ecosystem and the public sector. Her past work spans across India, South-East Asia and Africa focusing on affordable housing, housing finance, and financial inclusion alongside private sector partners, NGOs, and government bodies. Shilpa has also led a multitude of strategic business advisory projects, market assessments, impact evaluations, diagnostic studies, policy reform programs, applied research projects, and other market making efforts.

Prashant Das

Prashant Das, PhD is the Chairperson of the Finance & Accounting area and an Associate Professor of Real Estate at the Indian Institute of Management, Ahmedabad (IIMA). He has been a guest faculty at Harvard University, University of California, Irvine, and a visiting faculty at various universities in China and Romania. Earlier, he served as an Associate Professor and the Director of the Real Estate Institute at EHL Lausanne, Switzerland. At IIMA he developed an Agri Land Price Index (ISALPI) and an Art Price Index (IAIAI) for India.

He has authored over 25 research papers, 10 cases and three books. Two of his papers have earned the best paper awards from the Journal of Real Estate Research (USA). He has twice earned the Practitioner Research Award from the American Real Estate Society. He serves on several industry/academic/editorial boards or committees. His research interests include commercial real estate (private equity, REITs, MBS, and hotels), behavioral real estate, and sustainability. Prashant earned his Ph.D. from Georgia State University (Atlanta, USA); M.S. from Texas A&M University (College Station, USA), and B.Arch. from IIT Roorkee (India). He served in the industry for a few years before assuming an academic role. In his free time, Prashant likes to write short stories and poems, does oil painting on canvas, travels, and sculpts in clay and wood.

Arun Sharma

Arun Sharma is working as Senior Digital Development Specialist with the World Bank, based in New Delhi where he leads the Bank’s Digital portfolio in India.

Prior to joining the World Bank, Arun was a part of the Indian civil services for over two decades. He has worked in various Ministries such as Finance, Housing & Urban Affairs, the Cabinet Secretariat and MEITY, where he was Officer on Special Duty (OSD) to the Hon’ble Minister of State.

Arun was instrumental in setting up the Direct Benefits Transfer (DBT) Mission in the Cabinet Secretariat. He has also worked with the International Finance Corporation (IFC), in the Payments practice in South Asia.

Arun’s professional interests include digitisation, public financial management, government payments systems, digital ID, and financial inclusion. He holds an MBA from Indian School of Business, Hyderabad, and a Bachelor of Technology from the Indian Institute of Technology, BHU, India

Carmen Vicelich

Carmen Vicelich is an entrepreneurial powerhouse with over 20 years' experience developing innovative technology and data solutions that deliver impact to make the world a better place. In record time she has created several purpose and impact driven, global businesses focused on just that.

Valocity transforms the property decisioning process, digitally connecting the entire property ecosystem of lenders, valuers, brokers, real estate agents, and customers in One Smart Platform to streamline property valuation and mortgage lending in over 2200 cities around the world. Valocity democratises access to the latest property data to manage risk, including climate change and hazard data at a property level to enable data driven decision making.

Outside of founding multiple businesses, Carmen is a well-known global public speaker, serves on several boards including UNICEF (United Nations International Children's Emergency Fund), Co-Chair of Fintech NZ and New Zealand India Trade Alliance and is proud mother of four children.

Carmen has been globally recognised for her entrepreneurial success and tenacity including Winning the EY Entrepreneur of the year 2023 in the Technology Category. Her business Valocity was named Scale Up of the Year, India 2022, and won runner up Singapore Fintech Festival 2022.