Stepping up Monetary Policy to Knock Economy

India’s coronavirus epidemic is now growing at the fastest rate in the world, rising at 20% over the last week with more than 1.4 million confirmed cases, with daily cases now at ~50,000 per day. This means that the lockdown restrictions are going to further continue which would continue to dampen the consumer sentiments and poses severe headwind to a recovery. In fact, fiscal stimulus announced earlier have been ineffective due to expenditure cuts and increased taxes on gasoline and related products. This has in fact, added pressure on inflation and one of the reasons for inflation rising to 6.1% in June 2020. This is against the consensus estimate of 5.3% [1] as well as higher than the RBI’s target range of inflation of 2-6%.

Given the above, they key driver at this moment in RBI’s radar would be growth, which has many are predicting to be below 0 levels for India. In fact, the consensus estimate is at -2.8% for the current year (2020-21) and therefore, rate cuts during the year are warranted at this point in time. Economists are expecting a prolonged ‘U-shaped’ recovery rather than a ‘V-shaped; recovery which was predicted in earlier times. The demand side, which has shown a weak recovery since early May on a phased reopening of the economy, now appears to have stagnated since Mid-June at depressed levels. India agriculture boost is only silver lining amid pandemic situation. Surplus monsoon rains and the migration of workers from urban areas to rural hometown due to lockdown are giving rise to a supply- led boost to agriculture activity. The cumulative rainfall surplus from 1 June to 25 July was 4.8% higher than the average leading to higher agriculture sowing of 18.5% YoY.

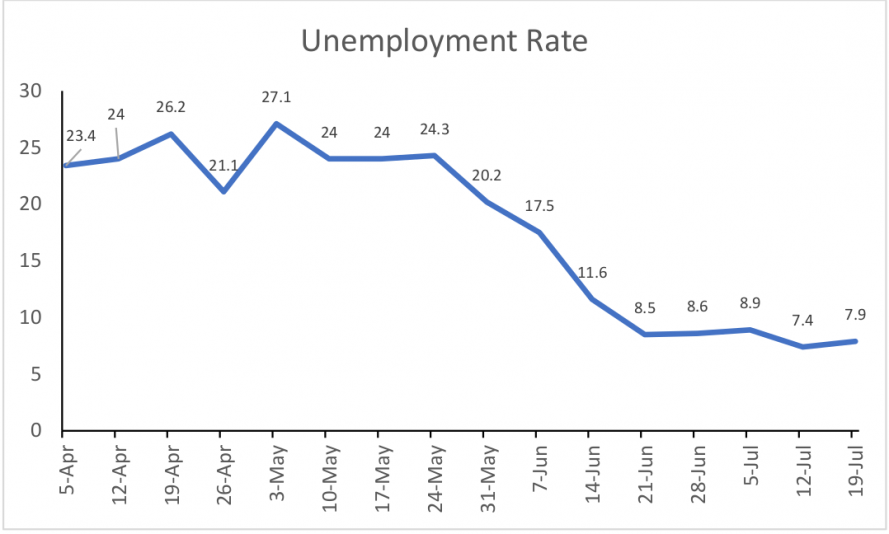

A drop in India’s unemployment rate masks underlying stress in the labour market. Massive migration of urban workers into rural villages marks a significant shift of labour from industrial and services sector into less productive rural activities. This is already leading to increased underemployment. Looking ahead, as demand for seasonal agricultural tasks wanes and the government’s rural expenditure runs into fiscal constraints, additional labour market stress could re-emerge.

Source: Data Sourced from Centre for monitoring Indian economy’s Consumer Pyramid’s Household Survey

Another reason for not keeping focus on inflation is because, it is expected that food prices, housing rent, retail prices to drop due to widening output gap due to demand slump. The recent pickup in food inflation is likely to be temporary and seasonal in nature. It reflects an increase in waste of perishable vegetables and fruits during the rainy months which is going to end in September. Post the monsoon, the food prices are expected to drop because of huge surplus of grains and other crops. The fundamental reasons for the surplus are increase in sharp jump of sowings, record government food grain stocks, higher levels of seasonal rains and excess labour availability.

Given the current economic conditions, a rate of 25 basis points is warranted with a guidance to further lower the policy rates in the year. The higher points rate cut was feasible at this point but for the high inflation in Q1 2020. It is expected that the policy rate to drop to 3% levels in June because of which economy can then get back into its normal system thereby, we can achieve GDP growth of >6% in FY 2021-22.

[1] As per Bloomberg estimate for June 2020